So, you designed a great survey, got the questions just right and have received a lot of responses. You are ecstatic about the successful survey design and distribution process. You have gotten your hands on a lot of data. By now you are probably wondering how to use all the data? What insights does it hold? How will it help you improve your revenue?

All of these are excellent questions and we’ll try to answer all of them in this blog post.

Data can teach you a lot about your customers. The more insights you have, the better you can plan your sales, promotion and advertising campaigns. Here is an example from a case study measuring customer attitudes towards soft drinks:

Accurate analysis of your own data can yield valuable results. Imagine knowing for certain what customers like and dislike about your products. You can quickly fix what isn’t working and continue improving what you have gotten right.

We won’t lie, analyzing the survey data is trickier than any of the previous steps in the process. We break down the analysis into simple steps to help you find valuable information.

There are four standard question/responses types and as a result you will have four different types of data to analyze depending on how you deigned the survey.

These are the unordered labels such as brand names, colors, types etc.

Example

What do you like most about our product?

This is what you do for all the responses which fall under the categorical data type:

Step 1: Calculate the total number of responses for each option

Step 2: Divide the number found in each category by the total

This gives you values called relative frequency statistics. Our example question and data yields the following relative frequency table:

| Option | Total Responses | Share in Overall Data | Percentage Share |

| Fast customer service | 30 | 30/100=0.3 | 30% |

| Ease of use | 40 | 40/100=0.4 | 40% |

| Quality | 16 | 16/100=0.16 | 16% |

| Quantity | 14 | 14/100=0.14 | 14% |

| Totals | 100 | 1 | 100% |

These results become more meaningful when grouped according to:

Based on scales such as “Never to Often” or “Strongly like to Strongly dislike” or “Strongly agree to strongly disagree”. These help asses “How much” kinds of questions

Example

How often do you use product X?

| Never | Rarely | Sometimes | Often | Always |

Create a frequency table to understand the importance of each option, here is a sample table showing the frequencies:

| Response Text | Never | Rarely | Sometimes | Often | Always |

| Corresponding Scale Value | 1 | 2 | 3 | 4 | 5 |

| Percentage | 3% (3) | 60% (60) | 5% (5) | 2% (2) | 30% (30) |

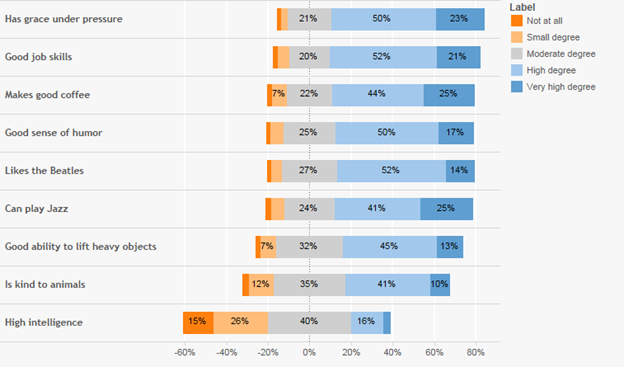

A great way to visualize this type of data is diverging bar charts, am example is shown below

Source: datarevelations.com

Ranges such as income level, number of employees etc.

Example

Indicate the number of employees in your company

This kind of data should be treated as if it is ordinal data if the intervals are even. In our example question, the intervals follow an even interval of 50, therefore the responses would be analyzed just as ordinal data. However if the intervals are uneven, treat it the same as nominal data.

This has a defined zero point for example height, annual sales, product defect rates, market share etc.

Example

How many hours do you spend browsing the Internet?

Ratio data is useful because it supports averages, specifically the arithmetic mean. You can simply take the numbers of ratio data and calculate the mean like this:

4+5+6/3=5

This gives a feel for where the responses are centered.

You can analyze how spread out the responses are by using statistical techniques such as standard deviation, correlation, regression, analysis of variance, etc.

Interval and ratio data are the most commonly used in market research, business and economics. This is mainly because many statistical methods can be applied to such data. But nominal and ordinal data can also prove to be useful in many cases. Here are some applicable analysis methods for each of the four survey data types.

It’s a good idea to share meaningful insights you gathered during the analysis process. I don’t mean to suggest that you share business-sensitive information, even general insights can be pretty valuable. Customers and industry experts are always interested in unique information.

Don’t just put up a huge table filled with numbers, no one will bother to read it. A better option is to present your data in fun ways, tell a story with your numbers. Popular survey tools such as SurveyCrest offer built-in features for generating charts, word clouds, etc.

Here are a few suggestions and examples of beautiful visuals for your inspiration:

Use monochrome icons to clarify your meaning and get your point across. A great example of a bar published by Search Engine Watch shows the following information in a bar graph:

This is quite a bunch of facts to fit in one chart and they managed to convey it clearly. The addition of icons is especially useful.

These show the most frequently used and therefore most important words in any block of text. Here are some free word cloud tools I use frequently: Wordle, Tagxedo, Tagul (this is the one I used to generate the graphic below) and Word It Out.

Online survey software will analyze and create word clouds from your survey data with just a few clicks, the following example was created using the Survey Crest word cloud tool.

These are great for showing sub-categories, this Techcrunch article uses this method to quickly convey demographic information about Facebook users.

This stunning example shows the global fintech (financial technology) investments classified by country. The data was collected by William Garrity Associates.

Use pie charts to show broad categorizations such as location of survey respondents, age group, or the percentage of specific responses. Here is the pie chart auto-generated by the Survey Crest tool during the testing process.

Alternatively, there are many online tools to generate a pie chart of survey data. One of them is the Pie chart calculator which helps to generate a pie chart and analyze the survey data to give remarkable results.

Surveys are only useful if you analyze them properly. A bunch of numbers hold immense insights into customer behavior and preferences. Discovering this information takes work, the use of proper techniques will prove invaluable to your survey goals.

Kelvin Stiles is a tech enthusiast and works as a marketing consultant at SurveyCrest – FREE online survey software and publishing tools for academic and business use. He is also an avid blogger and a comic book fanatic.